Investors European funds over the past three months received two serious blow: the capitalization of European companies fell by a decline in government expenditures, and debt crisis unleashed in Greece, the euro by almost 20%. At the same time, emerging market funds have shown themselves much better, falling by an average of 5% against 15% fall in Europe.

Fall has convinced some managers of international funds to pay attention to European equities, particularly for long-term investment. In fact, after shares of oil giant BP fell by 40% as a result of oil spills in the Gulf of Mexico, came a rare moment when the more profitable it became to invest in actively managed funds or individual stocks rather than indexes, like the index of SP’s Euro 350 ( BP takes it about 3%).

“We think that the European market meet the most undervalued assets that have excellent potential for global growth” – explains Cindy Sweeting, a portfolio manager Templeton Growth Fund (assets of $ 16.5 billion). – “While the mood in the markets of weaker countries of Europe such as Greece, obviously, is deteriorating, key performance indicators across the region – economic indicators and corporate profits – show an increase.”

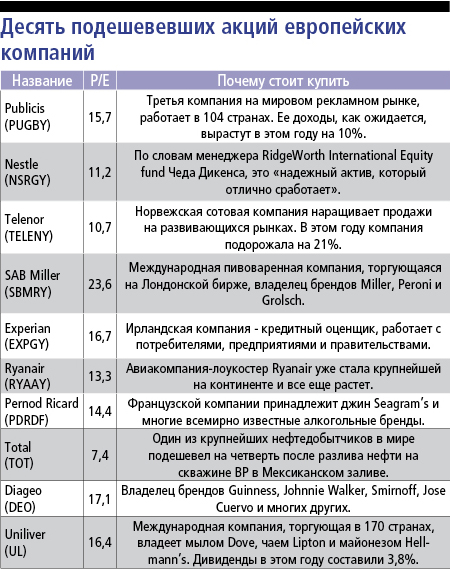

Part of the optimism of investors due to the fact that many in Europe are based multinationals such as Unilever and Diageo, earning mostly in the U.S. and in developing countries. For example, shares Diageo, which owns alcohol brands Johnnie Walker, Smirnoff and Jose Cuervo, fell 3% in three months and only 10% with respect to its annual maximum.

Shares in global European companies – a strategic interest in Chad Dickens, manager of RidgeWorth International Equity fund, invested another $ 235 million in undervalued, according to the company’s assets. “Everything fascinated debt crisis, which we think will be – he says. – This moment we invest in company affected than they deserve ».

In Dickens’ portfolio consists mainly of multinational companies like Nestle and SABMiller (Miller and brewer Grolsch): «SABMiller has plants in almost all continents, so the company benefits from growth in both Europe and in emerging markets such as Brazil and some African countries “.

Investors rejoice in the fall euro like the American tourists, who for their dollars can now buy more European currency than a year ago. “Before the crisis, it was hard to find assets for successful investment. Now, after the market correction, many risks have disappeared, “- says David Samra, head of Artisan International Value Fund, which manages assets of $ 2.3 billion to change its strategy to convince this fall of the euro. Now, Samra invested in companies that benefit from European growth. For example, the airline-loukoster Ryanair. “Budget deficits in the eurozone, of course, hinder the development of the economy, but it is not only a European problem,” – he concludes.

January 26th, 2011

January 26th, 2011  Журнал «Предприниматель»

Журнал «Предприниматель»

Опубликовано в рубрике

Опубликовано в рубрике  Метки:

Метки: